Gift Planning

Gifts of all types and sizes are welcome and appreciated! In addition to cash and in-kind gifts, you can contribute to the mission and future of Wheeling Health Right by utilizing special gift planning vehicles. These giving tools can vary and are described below. Planned (Legacy) gifts can mutually benefit you and your family as well as Wheeling Health Right, so we hope you will consider one or more of the following opportunities.

Bequests

We have sample wills language that you can use and provide to your attorney. Contact us and we will be happy to send it to you.

Retirement Assets

Life Insurance

Appreciated Securities

Charitable Remainder Trusts

Charitable Remainder Annuity Trusts allow you to donate assets into the trust and produce a fix income stream for you and/or loved ones for life or for a term up to 20 years. The income level you and/or loved ones receive is based on a percentage of the initial value of the assets used to fund the trust. This is a percentage that you and your advisor will set to produce the income you desire while also protecting the assets so there will be a charitable benefit to the charity(ies) you plan to help. After the annuity trust terminates, the remainder will benefit Wheeling Health Right and any other charities you might name.

Real Estate

A Retained Life Estate is a gift which allows you to donate your home to Wheeling Health Right while retaining the right to live in it for the rest of your life or until you no longer want to retain it. You will receive an income tax deduction for the remainder value of the home. You will continue to be responsible for all routine expenses such as maintenance, insurance, and taxes. You also have the option to rent all or part of the property to someone else or sell the property in cooperation us. When the life estate ends, we will either use the property or sell it to support our mission.

With any of these giving options you can make them as unrestricted donations or designate them for a specific purpose(s). You can also make any gift in honor or memory of a loved one(s).

Have you already included us in your estate plans?

Gary W. Mulhern

gmulhern@wheeelinghealthright.com

304-233-1135

Wheeling Health Right

61 29th Street

Wheeling, WV 26003

The above information is provided for educational purposes only. Wheeling Health Right does not provide legal, tax, or financial advice. We strongly recommend you consult professional advisors on all legal, tax, or financial matters, including gift planning considerations. To ensure compliance with certain IRS requirements, we disclose to you that this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of avoiding tax-related penalties.

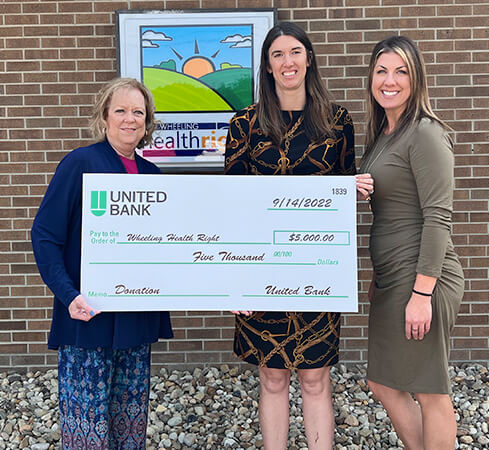

Every Dollar Makes a Difference

Donations

Sponsorship